The Medicare Decision That Matters More Than You Think

If you’re turning 65 soon, I don’t need to tell you that your mailbox has probably turned into a war zone of Medicare ads.

Shiny brochures. Friendly-looking seniors. Confusing charts. And somehow… nobody’s giving you a straight answer.

Here’s what I’ve learned after helping people with Medicare for over 20 years:

The plan that sounds good on paper isn’t always the one that’s good for you.

And that’s the whole point of this article — to make sure you walk away with real clarity and confidence. Not just about what each plan covers, but how to spot the difference between what’s being sold to you… and what actually fits your life.

Because in this story, you’re the one in control.

My role? Think of me as the guide who’s walked this road a thousand times. I’ll help you avoid the potholes, find the shortcuts, and understand the two major paths people choose at this stage:

Medicare Advantage and Medicare Supplement (also called Medigap).

By the time you’re done reading, you’ll know:

- Which plan gives you the most freedom with your doctors

- Which one might leave you with surprise bills (even when it says “$0 premium”)

- And how to pick a path that fits your real lifestyle, not just your budget

So take a breath, grab a cup of coffee, and let’s walk through this together.

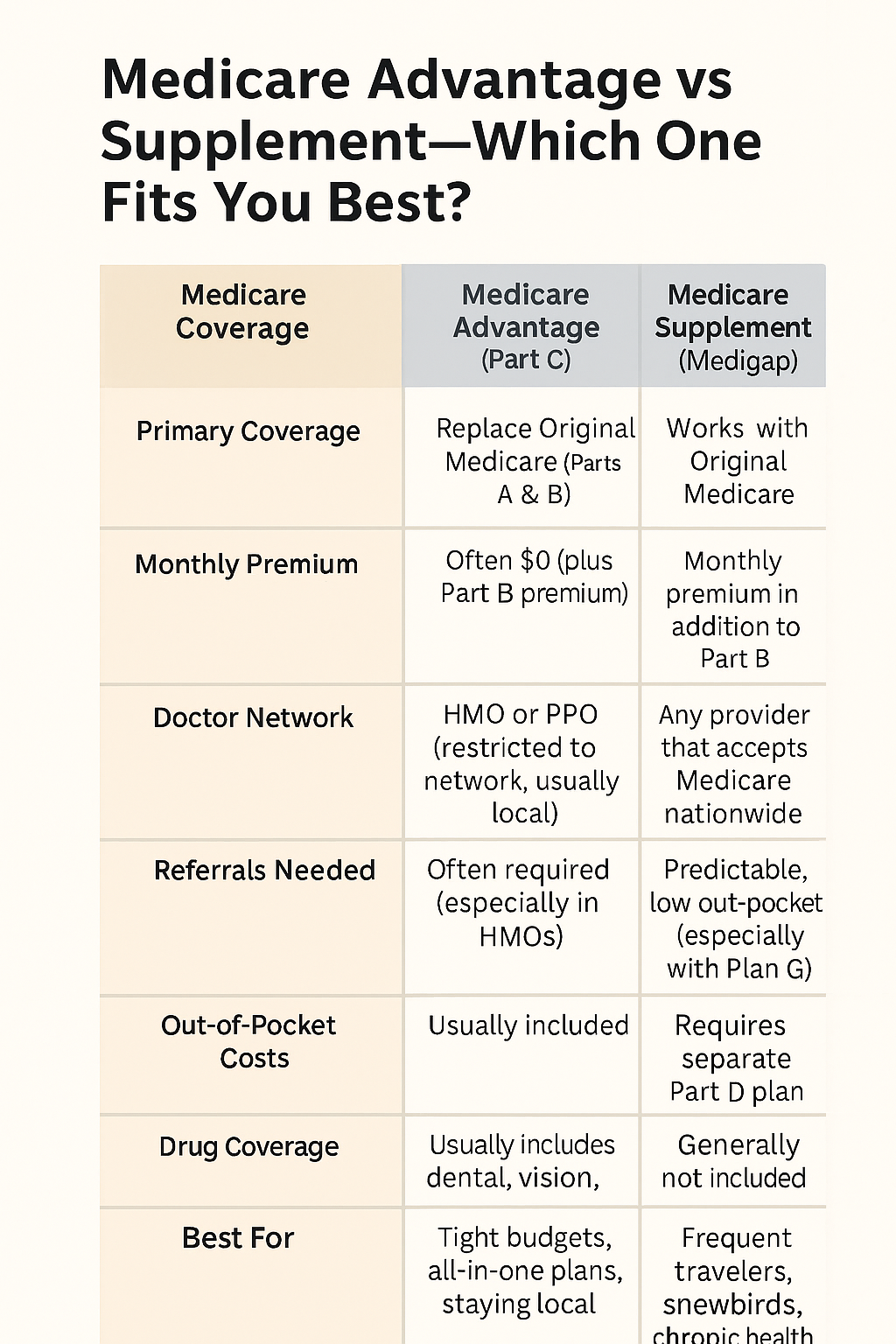

Medicare Advantage vs Medicare Supplement — What’s the Core Difference?

Let’s simplify this right out of the gate.

When people ask me, “Which one is better?” I always answer with a question:

“Do you want to pay less up front and follow more rules — or pay more up front for more freedom?”

Because that’s the real core of the difference.

Medicare Advantage (Part C): The All-in-One Option

Medicare Advantage rolls everything into one plan. It usually includes:

- Hospital (Part A)

- Medical (Part B)

- And often prescription drug coverage (Part D)

Many of these plans boast $0 premiums, dental/vision perks, and gym memberships. Sounds great, right?

But there’s a catch…

You have to use their network. That means:

- Your doctor might not be covered

- You may need referrals to see specialists

- You could face copays and prior authorizations for certain services

Think of it like an HMO or PPO plan. It works if you stay in the system.

Best fit for: Healthy individuals with a preferred network or those looking for a lower monthly cost.

Medicare Supplement (Medigap): Freedom with Predictability

Medicare Supplement plans fill the gaps in Original Medicare. These plans cover things like:

- Coinsurance

- Copays

- Deductibles

With most Supplement plans (like Plan G), you can see any doctor who accepts Medicare — anywhere in the U.S. No referrals. No network limits. Predictable costs.

But the monthly premium is usually higher, and you’ll need a separate Part D drug plan.

Best fit for: People who want freedom to choose doctors, travel often, or need predictable healthcare costs.

A Quick Story

I once worked with a client named Ron. He traveled between Nazareth Pennsylvania and Orlando Florida every year and wanted to keep seeing the same specialists in both states.

We looked at his options and realized a Medicare Advantage plan would limit him in one of those states. A Medicare Supplement plan gave him total freedom — no networks, no roadblocks.

That’s the power of choosing based on your life.

Understanding the Costs – What You Really Need to Know

Let’s be real: Medicare costs can feel like a confusing mess of premiums, co-pays, and deductibles. And while both Medicare Advantage and Medicare Supplement plans aim to help cover your healthcare expenses, how they do it — and what it costs you — can be very different.

Think of it like this:

Medicare Advantage is kind of like joining a gym with a low monthly fee… but every time you go, there’s a small charge. Medicare Supplement, on the other hand, is like paying more upfront for a VIP pass — but once you're in, you rarely have to pull out your wallet.

Let’s break it down:

What Medicare Advantage Offers — And When It’s the Right Fit

Let’s talk about Medicare Advantage — sometimes called Part C. If Original Medicare is the foundation, Medicare Advantage is like building a custom home on top of it.

It’s an all-in-one plan offered by private insurance companies that includes everything Original Medicare covers — plus some extras.

How Medicare Advantage Works

Instead of Medicare paying your doctors directly, it pays a private insurance company to manage your care. You still get all the benefits of Part A and Part B — but now through the plan’s network of providers.

Many plans also bundle in drug coverage (Part D) and extra perks you won’t get with Original Medicare alone.

What Makes Medicare Advantage Appealing?

- Monthly Premiums: Often low or even $0, depending on where you live.

- Out-of-Pocket Costs: You’ll pay co-pays and coinsurance for most services. These can add up if you need frequent care.

- Maximum Out-of-Pocket Limit: There’s a built-in spending cap each year. Once you hit that number, you won’t pay more for covered services.

HMO vs PPO — Explained Simply

When people hear “networks,” they often feel nervous. Let’s simplify:

- HMO (Health Maintenance Organization): You choose a primary doctor and stay in-network. It usually has lower costs, but less flexibility. You need referrals to see specialists. What’s an HMO (Health Maintenance Organization)?

- PPO (Preferred Provider Organization): You can see any doctor, in or out of network — but you'll pay less in-network. No referrals needed, more flexibility, higher premium. What is a PPO (Preferred Provider Organization)?

When Medicare Advantage Might Be a Great Fit

- You’re comfortable with a local doctor network.

- You want extra benefits like dental or vision included.

- You prefer a lower monthly premium, even if that means some copays.

- You’re okay with navigating referrals or provider directories.

I had a client named Janet who told me:

“I don’t mind staying in-network — I only see a few doctors, and I like them. But I do want dental, vision, and something affordable. Medicare Advantage gave me all of that.”

It’s not one-size-fits-all — but for many, it’s the best balance of value and benefits.

What Medicare Supplement (Medigap) Offers — The Peace-of-Mind Plan

If Medicare Advantage is all about value and bundled benefits, Medicare Supplement (also called Medigap) is about predictability, freedom, and control.

This is the plan for people who like to know exactly what to expect, especially when it comes to medical bills.

How Medigap Works

Medigap doesn’t replace your Medicare — it fills in the gaps. That’s where the name comes from.

You still have Original Medicare (Parts A and B), but a Medigap plan helps cover:

- Deductibles

- Copayments

- Coinsurance

- Unexpected hospital costs

You can see any doctor in the U.S. who accepts Medicare — no referrals, no networks, no drama.

Medicare Supplement (Medigap)

- Monthly Premiums: Typically higher (depending on your age, zip code, and the plan you choose).

- Out-of-Pocket Costs: Generally very low. Most plans cover nearly all your Medicare-approved expenses after Part B pays its share.

- No Annual Cap Needed: Because most of your costs are already covered, there’s rarely a surprise bill.

Why People Love Medigap

- Freedom to choose any doctor or hospital in the country — perfect if you travel.

Predictable costs — many plans cover nearly all out-of-pocket expenses.

No need for prior authorizations or referrals.

I once worked with a couple named Mike and Linda who split their time between Pennsylvania and Florida. They told me:

“We didn’t want to guess if our plan would work wherever we went — Medigap gave us that peace of mind.”

When Medigap Might Be a Great Fit

- You travel frequently, even across state lines.

- You see multiple specialists or manage ongoing health issues.

- You want low out-of-pocket costs, even if you pay a higher monthly premium.

- You prefer simplicity and nationwide access over extra perks.

💡 One thing to keep in mind: Medigap plans don’t include prescription drug coverage — so you’ll need a separate Part D plan for that.

But for many, especially those with chronic conditions or a desire to plan ahead, it’s worth it.

Here’s the truth:

- If you want predictable costs and the freedom to go to almost any doctor, Medigap might be your best friend.

- If you’re looking to save money upfront and don’t mind some co-pays or network restrictions, Medicare Advantage could make sense.

When I explain this to clients, I usually say: “Would you rather budget a little more each month and barely have to think about healthcare costs — or save now and pay as you go?”

There’s no wrong answer. It’s about what fits your lifestyle and peace of mind.

Real-World Examples — “Which Plan Did Janet Choose?”

Sometimes, the clearest way to understand the difference between Medicare Advantage and Medicare Supplement is to see how real people make their decisions.

Let me introduce you to Janet and Ron — two clients who both turned 65 this year.

Moral of the Story?

There’s no one-size-fits-all plan. It comes down to your health needs, budget, and how you like to access care.

✅ Want help choosing like Janet?

Schedule a free 1-on-1 call with me — I’ll help you compare your options, answer your questions, and find the right fit for you.

*Takes less than 30 seconds to book

No pressure. Just answers — from someone who’s helped thousands navigate this.

Hidden Costs People Overlook

Medicare ads love to talk about low premiums and extra benefits — and who doesn’t like saving money?

But after 20+ years helping people enroll in Medicare, I can tell you: the real cost of a plan isn’t always what shows up in bold print.

Let’s break down the hidden costs that catch people off guard — so you can make the smartest decision possible.

1. Medicare Advantage: Pay Less Now, Possibly More Later

Many Advantage plans offer $0 premiums — which sounds great. But you still have co-pays, deductibles, and sometimes out-of-network costs if you see a specialist or end up in the hospital.

And if you travel a lot or see providers outside your plan’s network, those bills can add up fast.

💡 Example: One client ended up with a $400 bill after getting a simple outpatient procedure while visiting family out of state — all because it wasn’t covered under their local HMO plan.

2. Medicare Supplement (Medigap): Higher Monthly Cost, Lower Surprise Bills

Supplement plans usually cost more upfront each month, but they’re designed to cover what Medicare doesn’t — like deductibles and coinsurance.

That means fewer surprises. You can budget with confidence, especially if you have ongoing health needs or just don’t like worrying about what a doctor visit might cost.

💡 Example: My client Ellie said, “I’d rather pay $130 a month and be done with it, than play the ‘what will this cost me?’ game every time I go to the doctor.”

3. Drug Plans, Referrals, and Extras

Whether you choose a Supplement or Advantage plan, don’t forget about:

- Prescription drug costs (Part D or bundled in Advantage)

- Referral rules for specialists (especially with HMOs)

- Extra benefits like dental — are they real coverage, or just a discount?

Sometimes what sounds “included” ends up being more of a marketing perk than actual savings.

Bottom Line?

- If you want predictability and freedom to travel, Medigap might be the better value.

- If you’re okay with some out-of-pocket costs and staying local, Advantage might stretch your dollars further.

When You Can Enroll — And Why Timing Matters

Medicare doesn’t just start when you turn 65.

There’s a specific window — and missing it can mean delays, penalties, and a lot of stress you don’t need.

But once you understand how it works, staying on track is easy.

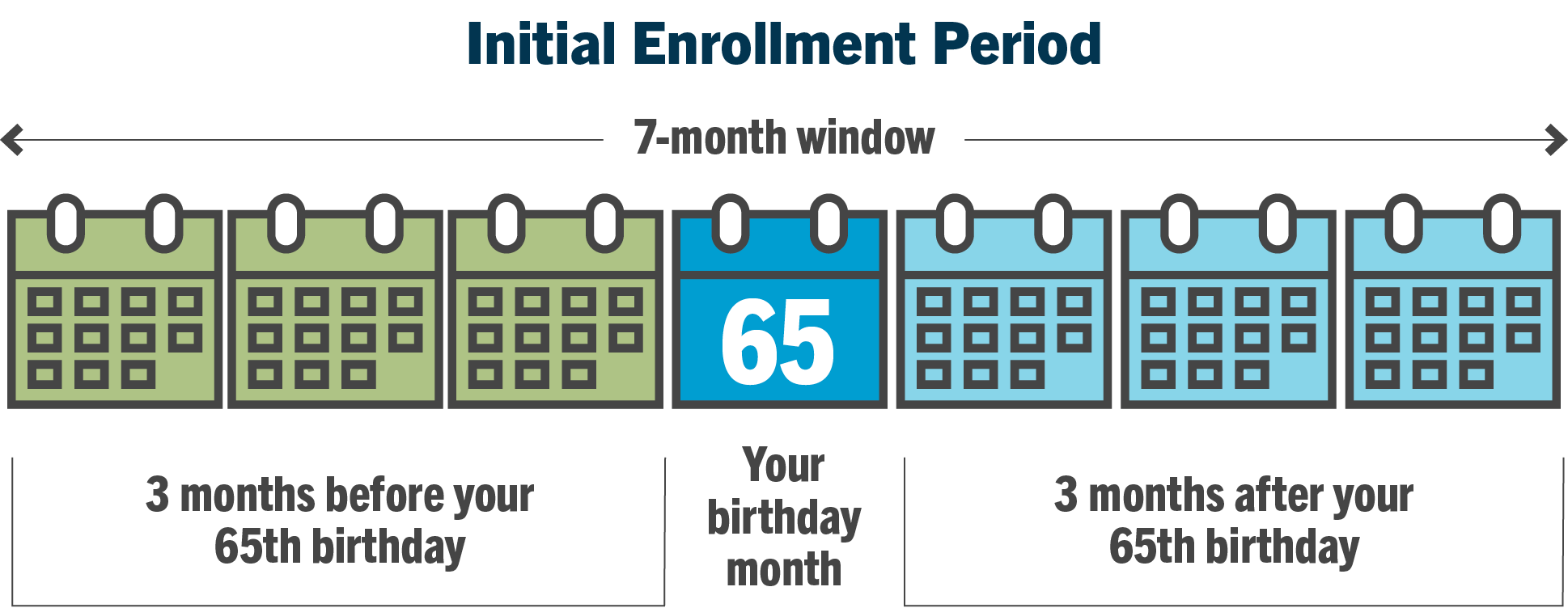

Your Initial Enrollment Period (IEP)

You get a 7-month window to enroll in Medicare Part A and Part B around your 65th birthday:

- Starts: 3 months before your birthday month

- Includes: your birthday month

- Ends: 3 months after your birthday month

💡 Example: If your birthday is in August, your enrollment window runs from May 1st to November 30th.

Why This Window Matters

✅ Enrolling early means your coverage starts smoothly — no gap, no rush.

🚫 Enrolling late (without qualifying for a Special Enrollment Period) could lead to:

- A 10% lifetime penalty on your Part B premium

- Delayed coverage start dates

- Limited access to certain plans

One of the most common Medicare mistakes I see is people assuming they can “just do it later.”

That’s when trouble starts.

Not Sure When to Enroll?

Use our quick calculator to find your enrollment window in seconds:

👉 Check Your Medicare Enrollment Window

You’ve made it this far — that tells me you care about getting it right.

Final Thoughts: The Best Medicare Plan Is the One That Fits You

After 20+ years in this field, I can tell you one thing for certain:

There’s no such thing as a one-size-fits-all Medicare plan.

TV ads, mailers, and call centers will all push their favorite option. But the best choice? It’s the one that fits your life, your doctors, and your budget.

Maybe that’s Medicare Advantage. Maybe it’s a Supplement with a solid Part D plan.

Either way, this is about you — not what’s most popular or most advertised.

Take your time. Ask questions. You deserve to feel confident about this.

No pressure. Just clarity.

👉 Need help deciding what fits you best?

Talk to a Licensed Advisor Today — It’s Free

Let’s make sure you walk away with answers — and peace of mind.