Turning 65 Medicare: Choosing between Medicare Advantage and Medigap Plan G is a pivotal decision for individuals approaching 65. This guide aims to clarify both options, helping you make an informed choice tailored to your healthcare needs and financial situation.

Medicare Plan Comparison Example: Meet Jane, Age 65

If you're turning 65 and trying to make sense of your Medicare options, you're not alone. Let’s walk through a real Medicare plan comparison example using Jane — a fictional (but very realistic) client we recently helped.

Jane is about to retire. She’s healthy, earns around $55,000 per year, and plans to travel regularly to visit her grandchildren. Like many people approaching Medicare, she’s received a mountain of mail and seen a hundred commercials… but she still wasn’t sure what to choose.

All Jane wanted was:

- To keep her doctors

- Avoid surprise bills

- Have clear, consistent healthcare costs

- Travel without worrying about coverage

In this case study, you’ll see how we compared Medicare Advantage and Medigap Plan G based on her specific goals — so you can better decide what’s right for you.

Jane compares Medicare Advantage and Medigap Plan G to understand the differences in coverage, provider networks, and total costs.

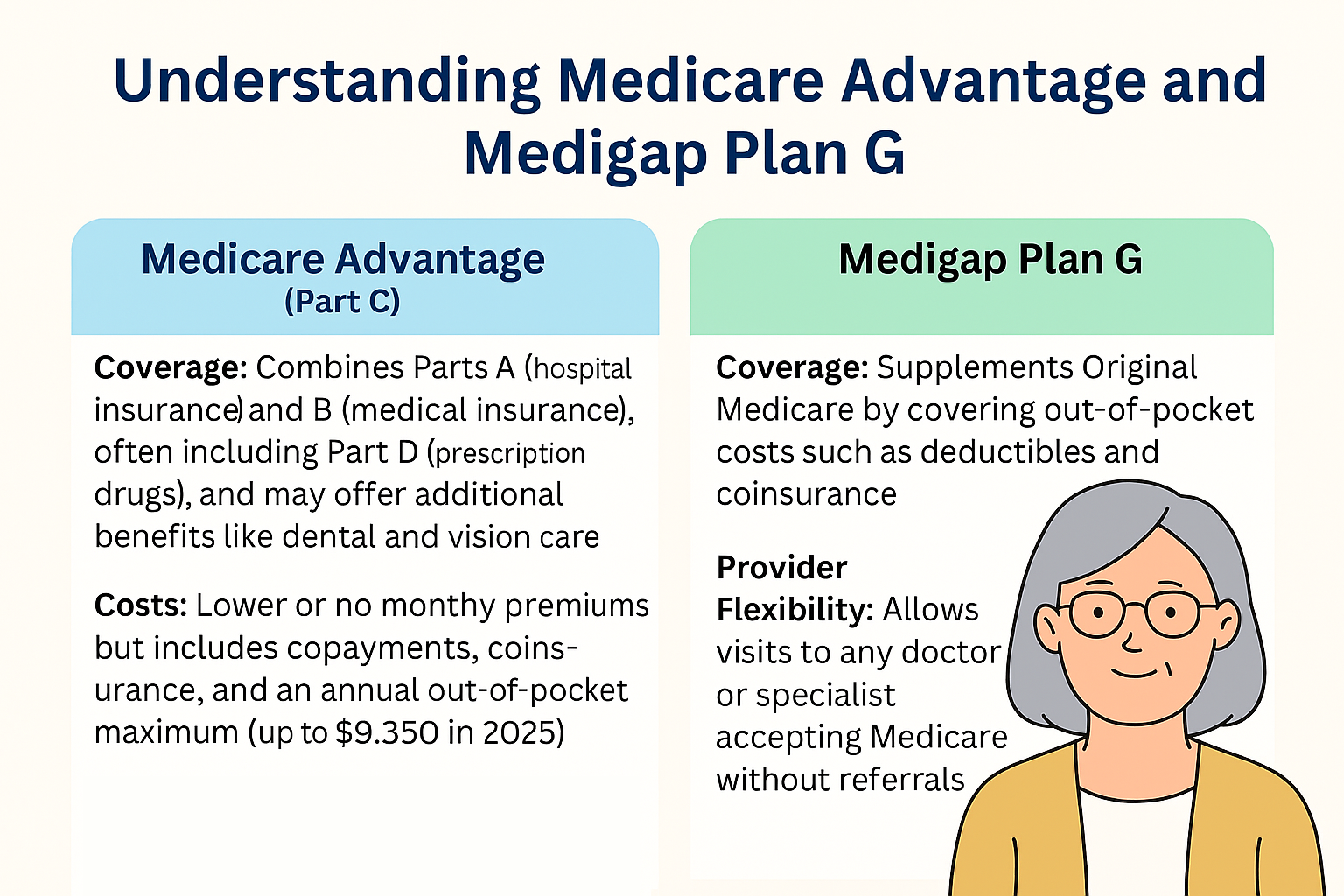

Understanding Medicare Advantage and Medigap Plan G

Medicare Advantage (Part C):

- Coverage: Combines Parts A (hospital insurance) and B (medical insurance), often including Part D (prescription drugs), and may offer additional benefits like dental and vision care.

- Provider Network: Typically requires using a network of doctors and hospitals.

- Costs: Lower or no monthly premiums but includes copayments, coinsurance, and an annual out-of-pocket maximum (up to $9,350 in 2025).

Medigap Plan G:

- Coverage: Supplements Original Medicare by covering out-of-pocket costs such as deductibles and coinsurance.

- Provider Flexibility: Allows visits to any doctor or specialist accepting Medicare without referrals.

- Costs: Monthly premiums averaging $150, with minimal out-of-pocket expenses after meeting the annual Part B deductible ($257 in 2025).

Jane compares Medicare Advantage and Medigap Plan G to find the right coverage for her lifestyle, doctors, and budget.

Jane's Considerations

- Healthcare Access: Jane values the freedom to choose her healthcare providers without network restrictions.

- Predictable Expenses: She prefers consistent and foreseeable medical costs to aid in budgeting.

- Comprehensive Coverage: Jane seeks extensive coverage to minimize unexpected medical expenses.

Comparing the Options

aSPECT | MEDICARE ADVANTAGE | MEDIGAP PLAN G |

|---|---|---|

Provider Choice | Limited to network providers; referrals may be needed. | Any Medicare-accepting provider; no referrals required. |

Out-of-Pocket Costs | Includes copays and coinsurance up to an annual limit. | Covers most out-of-pocket costs after the deductible is met. |

Premiums | Often lower monthly premiums. | Higher monthly premiums but fewer additional costs. |

Additional Benefits | May offer extra services like dental and vision care. | Does not typically include additional services. |

Jane's Decision

After evaluating her priorities, Jane opts for Medigap Plan G. This choice offers her the flexibility to consult any Medicare-approved doctor and ensures predictable healthcare expenses, aligning with her desire for comprehensive and stable coverage.

Not sure what Medicare plan fits you best?Jane made the right choice after comparing her real options. Now it’s your turn.

🎯 Take the 3-minute Medicare Quiz and see what plan fits your health, lifestyle, and budget.

Key Takeaways

- Medicare Advantage is suitable for those seeking lower premiums and additional benefits, comfortable with network limitations and variable out-of-pocket costs.

- Medigap Plan G appeals to individuals prioritizing provider flexibility and predictable expenses, accepting higher premiums for more comprehensive coverage.

Next Steps

Choosing the right Medicare plan is crucial. To explore your options further:

- Schedule a Personalized Consultation: Book an appointment with our experts.

- Take Our Medicare Supplement Quiz: Find the plan that fits your needs.

- Call Us Today: (833) 265-9655

For more information on Medicare plans and to make informed decisions, visit our Medicare Plans Overview.

Jane took action and called Lehigh Partners for Medicare help — now she’s confident in her plan choice. You can too.

Still comparing Plan G vs Advantage?We created a fast, no-pressure Medicare quiz to help you find the right fit.

🚀 No contact info required. Real plan suggestions in under 3 minutes.

Turning 65 Medicare Faq

You might not have to enroll immediately, but it depends on the size of your employer and your current coverage. If your company has 20+ employees, you may be able to delay Part B without a penalty — but always verify to avoid mistakes.

Medicare Advantage is an all-in-one plan with networks and copays, often with extra perks. Medigap (like Plan G) works with Original Medicare to cover your out-of-pocket costs, gives you provider freedom, and typically has a monthly premium.

In most areas, Medigap Plan G costs between $120–$170/month, depending on your zip code, age, and carrier. It offers nearly full medical coverage with minimal out-of-pocket expenses.

*Note: This article is for informational purposes and does not constitute medical or financial advice. Consult with a licensed professional for personalized recommendations.*