To switch your Medicare drug (Part D) plan, follow these steps:

- Joining a new plan: You can switch to a different Medicare drug plan by joining another drug plan during specific enrollment periods. These enrollment periods include the Annual Enrollment Period (October 15 - December 7), the Medicare Advantage Open Enrollment Period (January 1 - March 31), and Special Enrollment Periods for specific qualifying circumstances.

- No need to cancel old plan: There's no requirement to cancel your existing Medicare drug plan. When you enroll in a new plan, your old plan's coverage will automatically end.

- Timely action: It's advisable to join or switch plans as soon as possible. This ensures that you receive your membership card in a timely manner to start using your coverage and getting your prescriptions filled without any interruptions.

- Letter from new plan: Upon joining a new Medicare drug plan, you should receive a letter from the plan stating the start date of your coverage. Pay attention to this letter for important information.

- Protect your personal information: Avoid providing personal information to any plans that contact you unless you are already a member of that plan.

By following these steps, you can easily switch your Medicare drug or Medicare Advantage plan to better suit your needs and ensure continuous coverage for your healthcare needs.

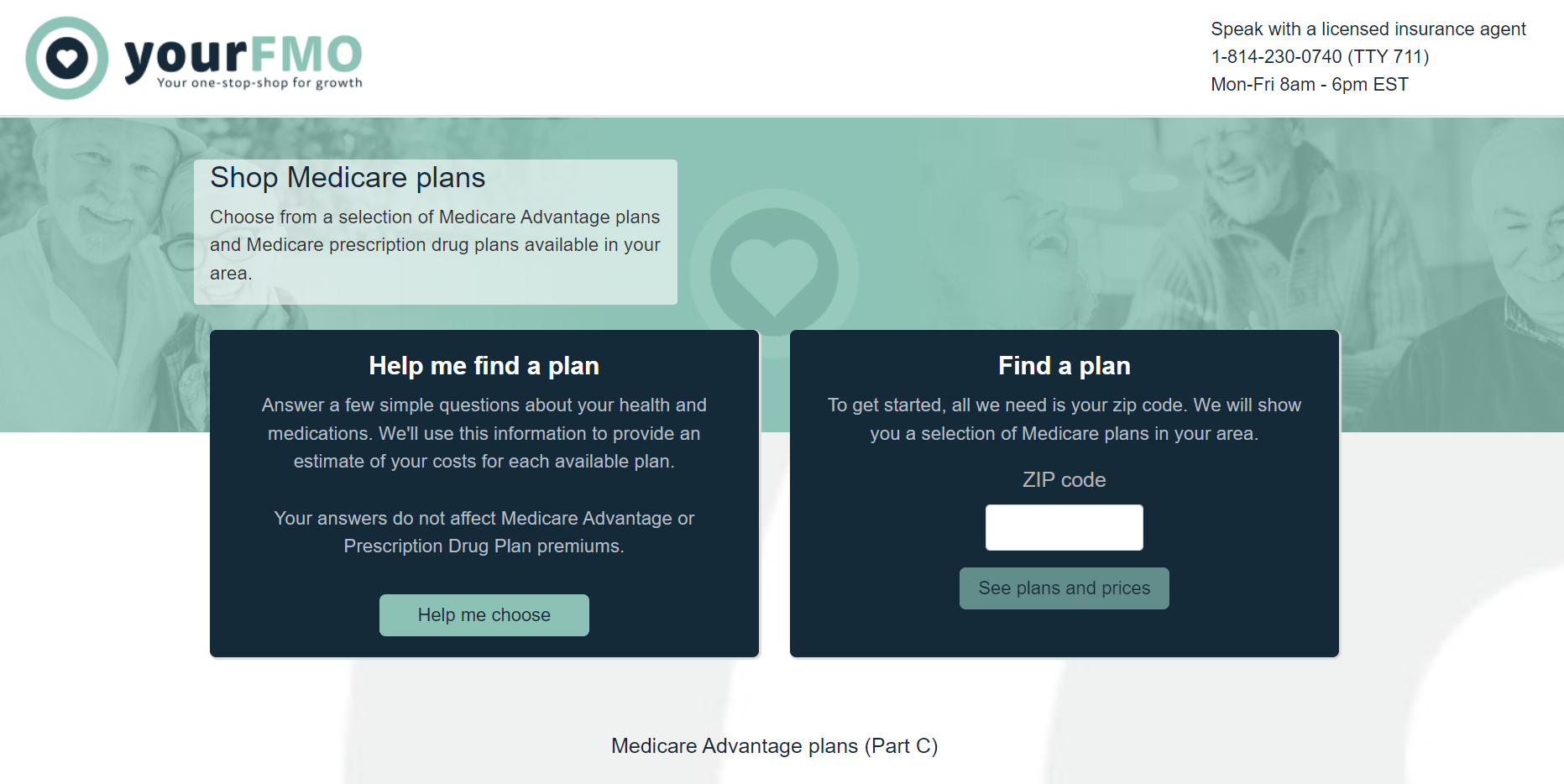

Choose from a selection of Medicare Advantage plans and Medicare prescription drug plans available in your area.

How to Join a Medicare Part D plan:

To join a Medicare Part D plan using the Medicare plan tool provided by SunFireMatrix, please follow these instructions:

- Visit the website: Go to the Medicare plan tool website by clicking on the following link: SunFireMatrix Medicare Plan Tool

- Enter your zip code: On the website, you will be prompted to enter your zip code. This allows the tool to display Medicare plans available in your area. Enter your zip code in the provided field and click on "See plans and prices."

- Explore Medicare plans: The tool will show you a selection of Medicare plans available in your area. You can find both Medicare Advantage (Part C) plans and Medicare prescription drug (Part D) plans. These plans are offered by private insurance companies.

- Compare plans: Review the plans and prices presented on the website. Take note of the details such as monthly premiums, coverage benefits, formularies, and additional services.

- Consider your health needs: Assess your healthcare needs and preferences. Determine whether you require prescription drug coverage (Part D) alongside Medicare Part A and Part B coverage.

- Select a Medicare Part D plan: Choose a Medicare Part D plan from the list that best meets your needs. Consider factors such as cost, coverage, network pharmacies, and any specific medications you may be taking.

- Enroll in the chosen plan: Once you have decided on a Medicare Part D plan, click on the respective plan or follow the enrollment instructions provided on the website. You will be guided through the enrollment process, which may involve providing personal information and completing necessary forms.

- Confirm enrollment: After completing the enrollment process, you will receive confirmation of your enrollment in the Medicare Part D plan. This confirmation will include information about your coverage start date and any next steps.

If you encounter any issues or have questions during the enrollment process, you can reach out to the licensed insurance agents at 1-814-230-0740, Monday through Friday, 8 am to 6 pm EST.

Remember to review the plan details carefully, including the terms and conditions, coverage limits, and cost-sharing requirements before finalizing your enrollment in a Medicare Part D plan.

Please note that this information is based on the details provided and may be subject to change. It's always a good idea to consult one of Lehigh Partners Agents directly for the most accurate and up-to-date information.

Why Switch Medicare Part D Prescription Drug Plans?

There are several reasons why someone might consider switching their Medicare Drug plan:

- Changes in medication coverage: Medicare drug plans have formularies, which are lists of covered medications. It's possible that a person's current drug plan may no longer cover their medications or that certain medications have been removed from the plan's formulary1. In such cases, switching to a different plan that provides coverage for their specific medications can be beneficial.

- Rising prescription costs: Prescription drug costs can vary significantly among different Medicare drug plans. If someone finds that their current plan is no longer cost-effective and their prescription costs have significantly increased, switching to a plan with more affordable options may help save money2.

- Access to preferred pharmacies: Some Medicare drug plans have preferred pharmacy networks, where certain pharmacies offer lower costs or additional benefits. If someone wants to ensure that their preferred pharmacy is in-network, they may choose to switch to a plan that includes their preferred pharmacy as a network provider3.

- Changes in personal circumstances: Individuals may experience changes in their healthcare needs or circumstances that warrant a switch in their Medicare Drug plan. For example, they may have new medical conditions that require different medications, or they may have moved to a different location where their current plan may not offer adequate coverage. In these cases, switching to a more suitable plan can better meet their evolving healthcare needs3.

It's important to note that when considering switching Medicare Drug plans, individuals should carefully review their options, compare the available plans, and consider their specific healthcare needs and preferences.