While Googling Medicare the first suggested search that I saw was "what Medicare supplement is best". While I can understand why someone would ask that question it is a hard one to really answer. It might be better to ask what Medicare supplement plan is best for me?" Even then it's not a cut and dry answer.

The best way to determine which plan might be the best for you would be to consider what type of benefits the various plans cover.

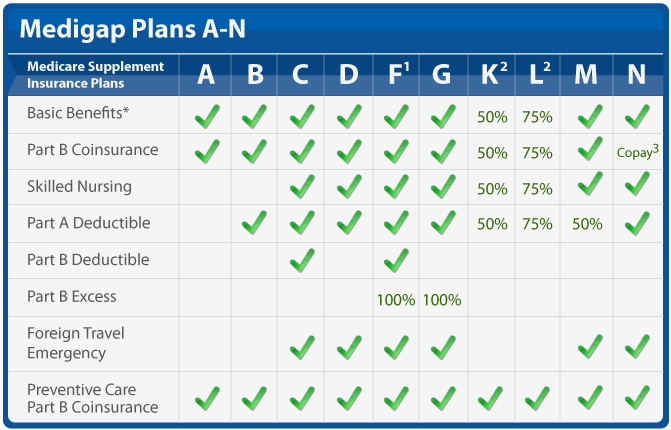

There are 10 Medicare supplement insurance plans. The plans are standardized, each plan is labeled with a letter of the alphabet (A, B, C*, D, F*, G, K, L, M, and N) and has a different combination of benefits. (Medicare Supplement insurance Plans A and B should not be confused with Medicare Part A and Medicare Part B.)

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs.

Basic Benefits:

- Coinsurance charges through Medicare Plan A (up to 365 days after Original Medicare benefits are spent).

- Hospice care copayments and coinsurance through Medicare Plan A.

- Copayments and coinsurance through Medicare Plan B.

- The first three pints of blood needed due to a medical procedure.

Medicare Supplement Plans

What is a Medicare Supplement

A Medicare Supplement, also known as Medigap, is a type of insurance policy sold by private insurance companies to help cover the gaps left by Original Medicare. Original Medicare (Part A and Part B) covers a significant portion of your healthcare costs, but it doesn't pay for all expenses. Medicare Supplement plans are designed to work alongside Medicare to cover expenses such as copayments, coinsurance, and deductibles that are not paid by Medicare.

For example, if you visit a healthcare provider and Medicare covers 80% of the approved amount for the service, the remaining 20% would typically be your responsibility. A Medicare Supplement plan can help cover some or all of that 20% portion, depending on the plan you choose. This can provide you with financial security and peace of mind knowing that you won't be left with unexpected out-of-pocket expenses.

One key aspect of Medicare Supplement plans is standardization. The government has standardized the coverage for each plan type, which means that every Plan A, for example, will offer the same benefits regardless of the insurance company selling it. This standardization simplifies the process for beneficiaries, as they can easily compare different plans based on coverage and costs without worrying about variations in benefits from one insurance company to another.

Standardization ensures that you know exactly what you're getting with each plan type, making it easier to choose the right plan for your needs. The standardized nature of Medicare Supplement plans also helps protect consumers from misleading or confusing marketing practices, as insurance companies must adhere to the set coverage guidelines for each plan type. This transparency and consistency in benefits across all insurers make navigating the world of Medicare Supplement plans clearer and more accessible for beneficiaries.

Why You Need Medicare Supplement

Having a Medicare Supplement plan is crucial for ensuring comprehensive coverage of healthcare expenses that are not fully covered by Original Medicare. While Original Medicare (Part A and Part B) provides significant coverage for hospital stays, doctor visits, and medical procedures, it doesn't cover all costs, leaving beneficiaries vulnerable to out-of-pocket expenses. This is where Medicare Supplement plans play a vital role in filling the gaps and providing financial protection.

A Medicare Supplement plan offers peace of mind by covering copayments, coinsurance, and deductibles that can quickly add up without additional coverage. This means you won't have to worry about unexpected healthcare costs that may strain your budget or savings. By having a Medigap plan, you can have predictable costs and better manage your healthcare expenses without the fear of being burdened by high out-of-pocket payments.

Furthermore, as healthcare needs can change unexpectedly, a Medicare Supplement plan provides flexibility and adaptability to address any new medical requirements that may arise. With varying plan options available, individuals can choose a plan that best suits their specific healthcare needs, ensuring comprehensive coverage tailored to their circumstances. Whether it's frequent doctor visits, prescription medications, or hospital stays, a Medicare Supplement plan can provide the necessary coverage to safeguard your health and financial well-being.

Medicare Supplement Plan Types

1 Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.) 2 For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year. 3 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Medicare Supplement Plan F

Plan F has long been the most popular Medigap plan due to its generous benefits, covering the Medicare Part A hospital deductible and co-payments, the Part B deductible, and even some emergency care outside the U.S. As of January 1, 2020, Plan F is no longer available to new beneficiaries as Medigap plans are no longer allowed to cover the Part B deductible. Existing enrollees can keep their coverage, but insurance companies may increase premiums as these plans can no longer accept new enrollees.

Medicare Supplement Plan C

Plan C shares many benefits with Plan F, but it does not cover the Part B excess charge, making the beneficiary responsible for any excess amount charged by a provider exceeding the approved Medicare program amount. Similar to Plan F, Plan C is no longer available to those who became eligible for Medicare after January 1, 2020, due to regulatory changes disallowing coverage for the Part B deductible.

Medicare Supplement Plan G

With the phasing out of Plan F, Plan G has become the plan of choice for many Medicare beneficiaries. While Plan F is considered the top-of-the-line Medigap policy, Plan G closely matches its coverage, except for the Part B deductible. Plan G also covers "excess charges" and has become a popular alternative for those seeking comprehensive Medigap coverage.

Medicare Supplement Plan D

Plan D is similar to Plan G as it covers more than most Medigap plans, but unlike Plan G it does not cover excess charges.

Medicare Supplement Plan M

Plan M is nearly identical to Plan D, but while Plan D covers the full Medicare Part A deductible, Plan M covers only half.

Medicare Supplement Plans K and L

Medicare Supplement Plan K and Plan L are cheaper than other Medigap policies. These two plans have lower monthly premiums, since you’ll also share the cost of coinsurance for your Plan K and L bills (50 percent for K and 25 percent for L) up to an annual out-of-pocket limit. The 2025 out-of-pocket (OOP) limits for Medigap Plans K and L are $7,220 and $3,610, respectively.

Your cost-sharing ends once you reach that annual Plan K or L out-of-pocket limit.

Medicare Supplement Plan N

If you don’t anticipate having many doctors’ visits, consider Plan N, which usually has lower premiums in return for some cost sharing. Plan N is the third most popular plan type, covering about 10% of all Medigap members. Plan N pays 100% of the costs of Part B services, except for copayments for some office visits and some emergency room visits. In 2025, Plan N copays are up to $20 for doctor visits and up to $50 for emergency room visits after the Part B deductible is met. Plan N also covers the Part A deductible, which is $1,676 in 2025. Plan N doesn't cover Part B excess charges.

Medicare Supplement Plans A and B

Plan A is ideal if you want more coverage than Medicare Parts A and B but don’t plan to use a lot of healthcare services. Plan A includes only the basics for Medigap plans — the benefits that every Medigap plan covers. Plan B provides the same benefits as Plan A, plus a little more coverage for hospitalization by paying the Part A deductible. The premiums are lower for Plans A and B, and while you won’t pay for extra coverage you might not use, you may have some occasional extra out-of-pocket costs.

High Deductible Plans

Medigap Plans F and G can be sold with a high deductible option. The high-deductible version of Plan F is only available to those who signed up for Medicare before January 1, 2020. High-deductible Plan G is available to individuals who are new to Medicare on or after January 1, 2020. The annual deductible amount for these three plans is $2,870 in 2025. The deductible amount for the high deductible version of Plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that you must pay, at which point your coverage will kick in.

The next factor in determining the best Medicare Supplement insurance plan for you is cost. Keep in mind that different insurance companies may charge different premiums for the exact same policy. This is due to standardization. For example, Medigap Plan G from one insurance company gives you the exact same coverage as Medigap Plan G from another insurance company. The only difference being the price.

Medicare Supplement insurance plans are rated or priced in 3 ways.

- The first way, “community-rated,” does not depend on age. People of different ages and gender pay the same premium. Premiums may go up because of inflation and other factors but not because of your age.

- The second way, “issue-age-rated,” sets the rate depending on the age of the person when he or she purchases the policy. Premiums may go up because of inflation and other factors but not because of your age.

- The third way, “attained-age-rated,” sets a premium at your current age and continues to go up as you get older. Premiums may also go up because of inflation and other factors.

Other factors may influence the price of the policy, such as if the health insurance company offers discounts to non-smokers or married people and if it uses medical underwriting. Medical underwriting could use a pre-existing health condition as a basis for charging a higher premium.

As you research the best Medicare Supplement plan for your coverage needs, here are some additional questions to consider:

- Do I want basic coverage or more coverage?

- Is there a specific out-of-pocket cost I want help with (copayments, coinsurance, deductible)?

- Do I want help with Part B excess charges when I visit doctors who don’t accept Medicare payment terms (assignment)?

- Do I travel outside of the country often and want overseas coverage?

- Do I want a high-deductible plan?

Which Medicare Supplement is best?

Understanding Medicare Supplement Plans: No One-Size-Fits-All Solution

When it comes to selecting a Medicare Supplement plan, it's essential to understand that there is no "best" plan that fits everyone's needs. Each individual's healthcare requirements, budget, and preferences differ, making it crucial to evaluate various factors before choosing a plan. What may work well for one person may not necessarily be the best option for another.

Most Popular Plans: Plan G and Plan N

While no single Medicare Supplement plan is universally deemed the best, Plan G and Plan N are currently among the most popular choices due to the comprehensive coverage they offer. Plan G typically provides coverage for all the gaps left by Original Medicare, except for the annual Part B deductible. This can result in minimal out-of-pocket expenses for beneficiaries once the deductible is met. On the other hand, Plan N also offers robust coverage but may require copayments for certain services, such as office visits and emergency room visits.

Considerations for Choosing between Plan G and Plan N

When deciding between Plan G and Plan N, individuals must carefully assess their healthcare needs and financial situation. Those who prefer comprehensive coverage with minimal out-of-pocket costs after meeting the deductible may find Plan G to be a suitable option. Alternatively, individuals who are willing to pay slightly lower premiums in exchange for copayments for some services may opt for Plan N.

Ultimately, the decision between Plan G and Plan N, or any other Medicare Supplement plan, should be based on an individual's unique circumstances and preferences. It's advisable to compare the benefits, costs, and coverage of different plans thoroughly before selecting the one that aligns best with your specific healthcare needs and financial considerations.

Once you understand what benefits you want to be covered and the pricing differences, you will be able to determine what the best Medicare Supplement insurance plan is for you.

Resources for Choosing the Right Medigap Plan:

Medicare provides valuable resources to assist in comparing and selecting the right Medigap plan for you. Utilize the coverage chart and online tools available on the Medicare website to evaluate the benefits and costs of each plan. Additionally, consider consulting with independent brokers like Lehigh Partners Senior Benefits or local agencies specializing in Medicare supplements for personalized guidance in choosing the best plan for your healthcare requirements.

Some people choose to enroll in a Medicare Advantage Plan as an alternative to Medicare Supplement Insurance. With most Medicare Advantage Plans, you will have to pay a co-pay, deductibles, and adhere to network restrictions. Medicare Advantage Plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare and provide all Part A and Part B coverage, often including prescription drug coverage as well. These plans may also offer additional benefits such as vision, dental, and hearing coverage, all in one package. Medicare Advantage Plans provide individuals with the convenience of receiving comprehensive healthcare benefits through a single plan, often at a lower cost compared to purchasing separate Medicare Supplement and Part D plans. Moreover, Medicare Advantage Plans may have provider networks and care management programs that can help coordinate care and manage costs.

Why Lehigh Partners Senior Benefits is a valuable resource:

Lehigh Partners Senior Benefits is a valuable resource for selecting the right Medigap plan due to our expertise and specialization in Medicare supplements. Our team can provide personalized guidance and tailored recommendations based on your specific healthcare needs, ensuring that you find the best plan to meet your requirements effectively.

Sharing valuable resources like this informative article on determining the best Medicare supplement plan can greatly benefit others navigating the complexities of healthcare coverage. By sharing this detailed guide, you can empower individuals to make informed decisions about their Medicare options, leading to better financial protection and healthcare choices. Additionally, creating a backlink to this article can enhance the accessibility of this important information, allowing more people to access and benefit from the comprehensive insights provided. Help spread awareness and support others in making well-informed decisions by sharing or linking to this valuable resource on Medicare supplement plans.

https://lehighpartners.net/2020/12/what-medicare-supplement-is-best/