While Googling Medicare the first suggested search that I saw was “what Medicare supplement is best”. While I can understand why someone would ask that question it is a hard one to really answer. It might be better to ask what Medicare supplement plan is best for me?” Even then it’s not a cut and dry answer.

The best way to determine which plan might be the best for you would be to consider what type of benefits the various plans cover.

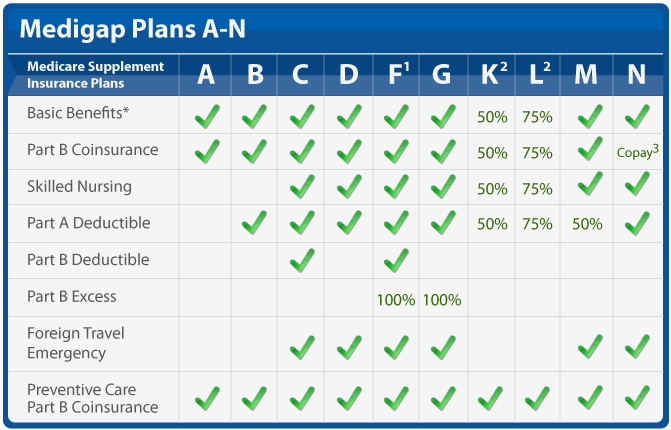

There are 10 Medicare supplement insurance plans. The plans are standardized, each plan is labeled with a letter of the alphabet (A, B, C*, D, F*, G, K, L, M, and N) and has a different combination of benefits. (Medicare Supplement insurance Plans A and B should not be confused with Medicare Part A and Medicare Part B.)

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs.Basic Benefits:

Basic Benefits:

- Coinsurance charges through Medicare Plan A (up to 365 days after Original Medicare benefits are spent).

- Hospice care copayments and coinsurance through Medicare Plan A.

- Copayments and coinsurance through Medicare Plan B.

- The first three pints of blood needed due to a medical procedure.

1 Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren’t available to people who were newly eligible for Medicare on or after January 1, 2020.)

2 For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

3 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in inpatient admission.

The next factor in determining the best Medicare Supplement insurance plan for you is cost. Keep in mind that different insurance companies may charge different premiums for the exact same policy. This is due to standardization. For example, Medigap Plan G from one insurance company gives you the exact same coverage as Medigap Plan G from another insurance company. The only difference being the price.

Medicare Supplement insurance plans are rated or priced in 3 ways.

- The first way, “community-rated,” does not depend on age. People of different ages and gender pay the same premium. Premiums may go up because of inflation and other factors but not because of your age.

- The second way, “issue-age-rated,” sets the rate depending on the age of the person when he or she purchases the policy. Premiums may go up because of inflation and other factors but not because of your age.

- The third way, “attained-age-rated,” sets a premium at your current age and continues to go up as you get older. Premiums may also go up because of inflation and other factors.

Other factors may influence the price of the policy, such as if the health insurance company offers discounts to non-smokers or married people and if it uses medical underwriting. Medical underwriting could use a pre-existing health condition as a basis for charging a higher premium.

As you research the best Medicare Supplement plan for your coverage needs, here are some additional questions to consider:

- Do I want basic coverage or more coverage?

- Is there a specific out-of-pocket cost I want help with (copayments, coinsurance, deductible)?

- Do I want help with Part B excess charges when I visit doctors who don’t accept Medicare payment terms (assignment)?

- Do I travel outside of the country often and want overseas coverage?

- Do I want a high-deductible plan?

Once you understand what benefits you want to be covered and the pricing differences, you will be able to determine what the best Medicare Supplement insurance plan is for you.

Lehigh Partners Senior Benefits licensed insurance agents can help you compare plans in your area, or you can compare plans on your own by visiting our resource at www.medicareful.com/medicare.