As you approach the age of 65, transitioning to Medicare becomes an imminent reality. Understanding Medicare's intricacies can ensure that you receive the benefits you're entitled to without any unnecessary delays or penalties. If you're approximately six months away from Medicare eligibility, it's crucial to begin preparing now. Here’s what you need to know.

Understanding Medicare Basics

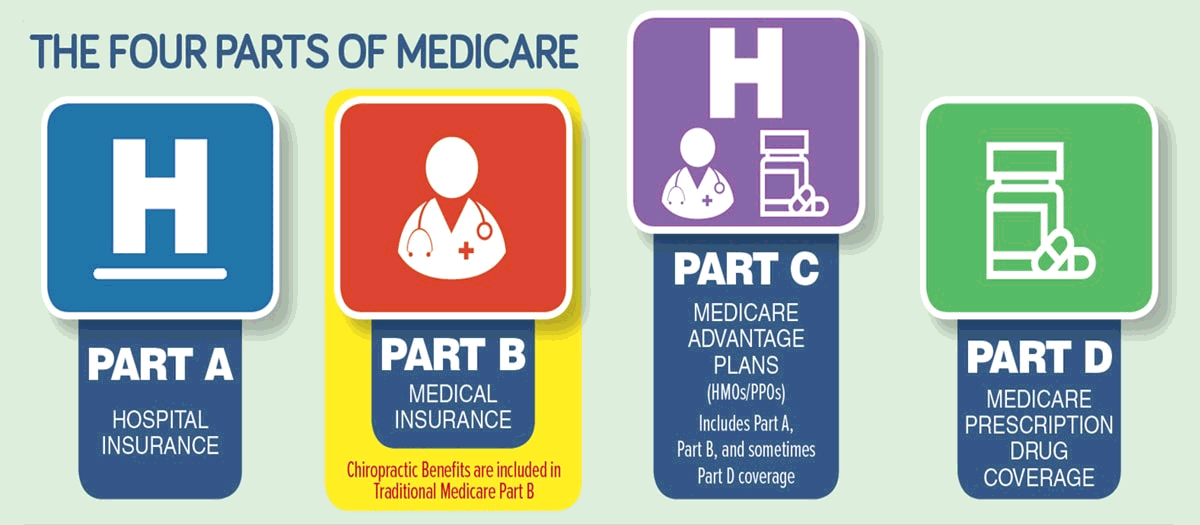

Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It consists of various parts that cover specific services:

- Medicare Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B (Medical Insurance): Covers certain doctors' services, outpatient care, medical supplies, and preventive services.

- Medicare Part C (Medicare Advantage Plans): A type of Medicare health plan offered by a private company that contracts with Medicare to provide all your Part A and Part B benefits.

- Medicare Part D (prescription drug coverage): Adds prescription drug coverage to Original Medicare, among other coverage options.

Key Steps to Prepare for Medicare Eligibility

Mark Your Calendar

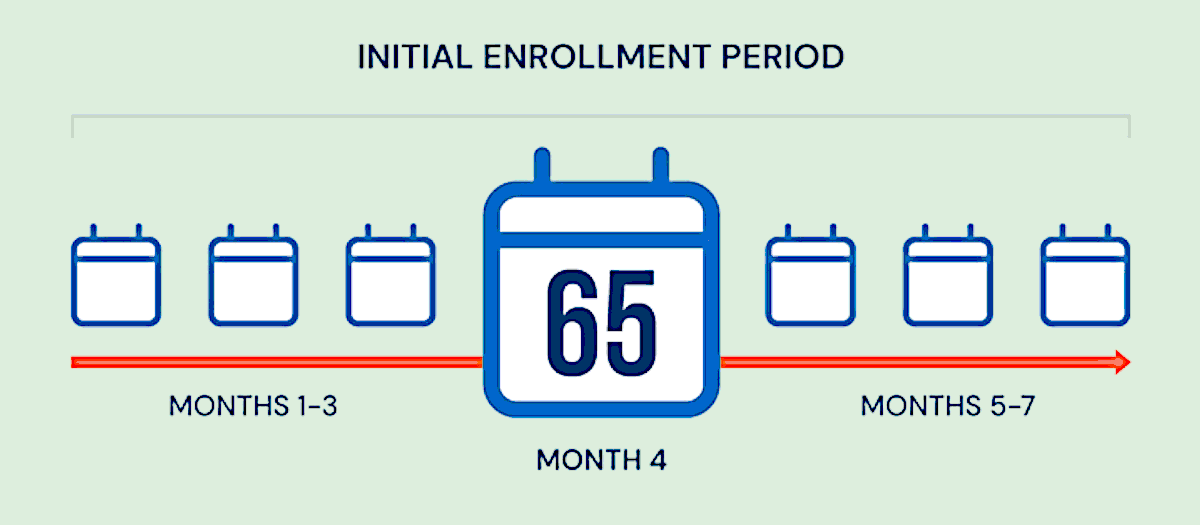

You have a seven-month Initial Enrollment Period (IEP), which includes the three months before you turn 65, your birth month, and the three months after. Enroll during this period to avoid late enrollment penalties.

Understand Your Options

Do you want Original Medicare or a Medicare Advantage Plan? Would you benefit from added prescription drug coverage (Part D) or Medigap, a supplemental insurance? Compare the costs, benefits, and network restrictions before deciding.

Check for Special Situations

Are you still working and covered under an employer's health plan? You might be able to delay Part B or Part D without a penalty. Consult with your HR department and the Social Security Administration.

Gather Necessary Documents

Have your identification and legal documents, like your birth certificate and Social Security card, accessible for an easy enrollment process.

Budget for Costs

Be prepared for premium costs, deductibles, co-pays, and coinsurance. Know that Medicare doesn't cover everything; for instance, long-term care and most dental care are out-of-pocket expenses unless you have additional coverage.

Seek Help

Consider contacting a Medicare counselor or attending a workshop for personal guidance. Also, ensure you get all your information from reliable sources like medicare.gov or an agent who is licensed and specializes in Medicare.

Don’t Delay

Procrastination can lead to penalties and gaps in your health insurance coverage. Get started early to ensure a smooth transition as you become Medicare eligible.

Remember, enrollment into Medicare is a critical life event that calls for detailed planning. With the right information at your fingertips, you can look forward to enjoying your Golden Years with suitable coverage and peace of mind.