What is the Most Popular Medicare Supplement Plan

With the 10 different Medicare Supplement choices, you might be wondering which ones are the most popular in 2021.

Download the FREE ebook

Get a guide to choosing a Medicare Supplement Plan. Our guide provides answers to many questions and provides advice for purchasing Medigap plans.

Which Medigap Plans Are the Most Popular

Until 2020, the most popular Medicare Supplement plans (Medigap) are Plan F, Plan G, and Plan N. High-Deductible versions of Plan F and Plan G are also available. Then came along this law called MACRA that went into effect and changed a few things about the Medigap choices you have.

Without giving a full explanation of that law, it limited the new enrollee’s in Plan F and C to people who were only eligible for Medicare prior to January 1, 2020. Those plans are still available, you just must have been eligible for Medicare prior to 1/1/2020.

Plan F

Plan F is the most comprehensive Medicare supplement plan. It covers the Part B deductible and everything covered by Plan G. After Medicare pays its share, Medicare supplement Plan F pays the rest.

This leaves beneficiaries with $0 out-of-pocket expenses. Enrollees pay a monthly premium, but they do not need to pay deductibles or copays. Plan F includes full benefits and provides proper coverage for beneficiaries who require treatments for chronic conditions.

Remember this plan is only available to beneficiaries who have been eligible for Medicare prior to January 1, 2020. Since it is the most comprehensive plan we still wanted to include it in this list.

An excellent choice for those who:

- Frequent doctors’ office and hospitals

- Live in a state that allows excess charges (if your state allows excess charges, it does not mean your doctor charges them)

- Often travel outside the United States

Plan G

Plan G is like Plan F. However, with Plan G, beneficiaries are responsible for the Part B deductible.

Now that Plan F is not as widely available, Plan G has gained even more popularity. It also makes more financial sense to many beneficiaries.

A wise option for those who:

- Prefer predictable out-of-pocket hospital costs and rate increases

- Reside in a state that allows excess charges

- Enjoy traveling outside of the United States

A high-deductible version of Plan G became available this year. It is a replacement for High Deductible Plan F. High Deductible Plan F provides identical benefits to standard Plan F (as well as a higher deductible that the beneficiary must pay in exchange for the lower premium).

Both standard and High Deductible Plan F are no longer available to newly eligible beneficiaries. Any Medicare-eligible beneficiary, regardless of when they become eligible, can enroll in High Deductible Plan G.

A more affordable option for those who:

- Want the same benefits as the standard version

- Are not happy with the premium of the standard version

- Occasionally have doctor appointments and visit hospitals

- Enjoy traveling outside the United States

- Live in a state that allows excess charges

Plan N

Plan N is one of the most popular Medicare Supplement plans for all beneficiaries.

A popular option for those who:

- Wish to keep their monthly premiums comparatively low

- Are accepting of small copayments

- Live in a state that does not allow excess charges, or are otherwise not worried about them

This plan requires beneficiaries to pay small copayments. For example, $20 for a doctor visit and $50 for an emergency visit. There are no copays required if you visit a local urgent care facility. However, excess charges are not covered by this plan. This will not be a concern for you if live in a state that does not allow excess charges. The states that prohibit Part B excess charges are as follows: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont. If you want a lower premium and are comfortable with more copayments, this plan could work well for you.

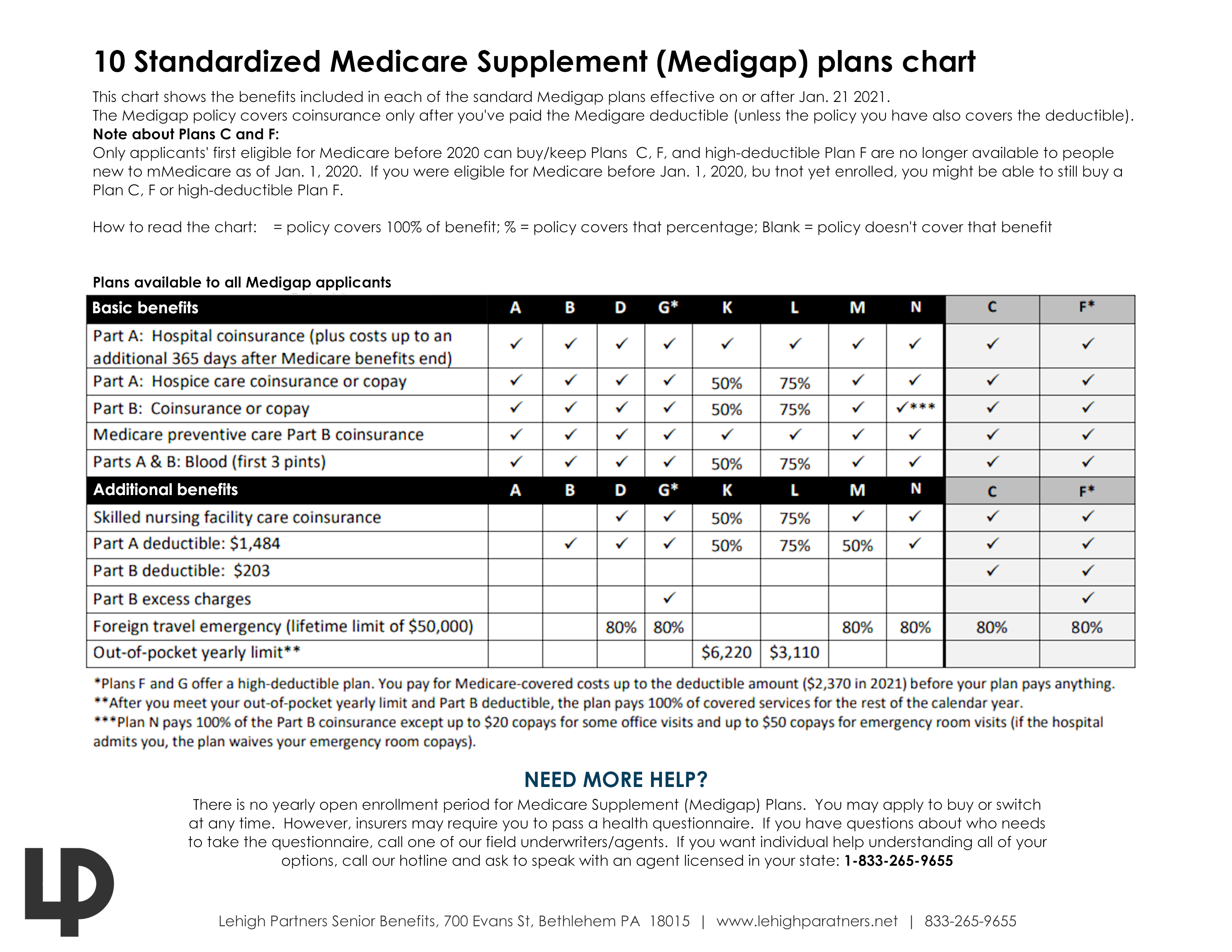

The chart above shows basic information about the different benefits Medigap policies cover.

How to Compare Rates for the Most Popular Medicare Supplement Plans

You can compare Medicare supplement plans by visiting our online rating page or requesting a call back from an agent, regardless of when you became Medicare-eligible. We will help you find the best letter plan and carrier for your health and budget needs.