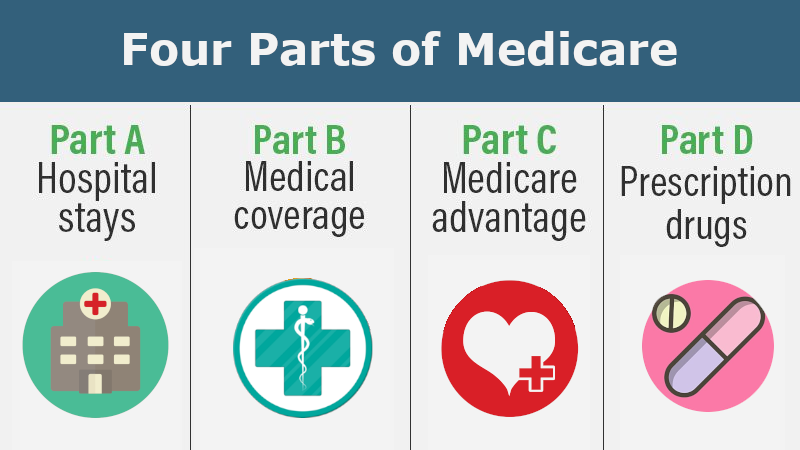

Navigating healthcare can be complicated, but knowing about Medicare can help you make informed decisions. Medicare is a federal health insurance program with four parts: Part A, Part B, Part D, and Part C. Understanding these parts can help you plan for healthcare, choose the right treatments, avoid late fees, and ensure you get the care you need.

Medicare Part A:

Medicare Part A, also known as Hospital Insurance, covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health services.

- Hospital Care: Covers costs like a hospital stay, nursing care, and necessary services for surgeries and treatments.

- Skilled Nursing Facility Care: Includes services needed after a hospital stay, like rehabilitation and skilled nursing care.

- Hospice Care: Supports individuals with terminal illnesses and their families.

- Home Health Services: Offers limited coverage for part-time skilled nursing care and therapy services.

While Part A covers many hospital expenses, there may still be out-of-pocket costs like deductibles and coinsurance. Most people are automatically enrolled in Part A when they turn 65, but some may need to apply if they don't meet the criteria.

Eligibility for Part A:

People 65 and older who have paid Medicare taxes for at least 10 years are eligible for Part A. Some under 65 with disabilities may also qualify. Individuals with certain conditions like End-Stage Renal Disease can be eligible in specific situations.

Key Benefits and Services of Part A:

- Inpatient Hospital Care: Includes room and board, nursing care, and necessary supplies during hospital stays.

- Skilled Nursing Facility Care: Provides services after a hospital stay when medically necessary.

- Hospice Care: Offers comprehensive support for individuals with terminal illnesses and their families.

- Home Health Services: Covers skilled care and therapy services when medically necessary.

Though Part A offers essential services, it may involve out-of-pocket costs depending on the services received.

Enrolling in Part A:

- Automatic Enrollment: Most people turning 65 and already receiving Social Security benefits are automatically enrolled.

- Manual Enrollment: Those not automatically enrolled can sign up during specific enrollment periods.

- Special Circumstances: Some under 65 with disabilities can qualify, while those with End-Stage Renal Disease have separate enrollment options.

To enroll in Part A, visit the Medicare website or contact the Social Security Administration. Enrolling on time is crucial to avoid penalties or gaps in coverage. If you need help, consider reaching out to a Medicare counselor or the SSA for guidance.

Medicare Part B Overview

Medicare Part B, also known as "Medical Insurance," helps cover a variety of medical services and outpatient care outside of hospitals. Here's a simple breakdown of what Medicare Part B includes:

What's Covered by Medicare Part B

- Doctor’s Services: Covers visits, consultations, and medical exams by healthcare professionals.

- Outpatient Care: Includes services at clinics and surgical centers.

- Preventive Services: Covers vaccinations, screenings, and wellness visits.

- Durable Medical Equipment (DME): Includes wheelchairs, oxygen supplies, and more.

- Medical Tests and Lab Services: Covers diagnostic tests and screenings.

- Emergency Ambulance Services: Provides ambulance transport to hospitals.

- Mental Health Services: Includes therapy and evaluations.

- Limited Prescription Drugs: Covers certain outpatient medications.

- Rehabilitation Services: Includes physical and occupational therapy.

- Preventive Screenings and Counseling: Helps with early detection and prevention of health issues.

Eligibility for Medicare Part B

- Age-Based Eligibility: Generally for individuals aged 65 and older.

- Automatic Enrollment: If receiving Social Security benefits, Medicare card is sent automatically at 65.

- Manual Enrollment: Sign up during the Initial Enrollment Period.

- Special Enrollment Circumstances: Some with certain disabilities may also be eligible.

- General Enrollment Period: If missed initial enrollment, enroll from January to March.

- Late Penalties: Enroll during the right period to avoid penalties.

Key Benefits and Services

- Covers a range of medical services, equipment, and care.

- Includes doctor's services, outpatient care, preventive services, and more.

- Offers assistance with costs like premiums and co-payments.

How to Enroll in Medicare Part B

- Automatic Enrollment: If receiving benefits, you are enrolled at age 65.

- Manual Enrollment: Sign up during specific enrollment periods.

- Special Enrollment Circumstances: Some with disabilities may qualify.

- Voluntary Delay: Can delay enrollment if still working with group health coverage.

To enroll in Medicare Part B, visit the official Medicare website or contact the Social Security Administration for assistance. Make sure to enroll during the right period to avoid late penalties and ensure access to necessary medical services and care.

Understanding Medicare Part C (Medicare Advantage)

Medicare Part C, also known as "Medicare Advantage," gives Medicare users a different way to get their Medicare benefits from private insurance companies. These plans offer the same coverage as Original Medicare (Parts A and B) and often have extra benefits.

What Medicare Part C Covers

- Full Coverage: Medicare Advantage covers everything from Original Medicare, like hospital care and doctor visits. Users can see a wide range of doctors and healthcare facilities.

- Extra Benefits: Medicare Advantage can include more benefits, like prescription drugs, dental care, vision, hearing aids, wellness programs, and gym memberships.

- Managed Care: Many Medicare Advantage plans work under managed care, meaning users may need a primary doctor, referrals to see specialists, and must use specific healthcare providers. Some plans may cover out-of-network services.

- Costs: Medicare Advantage plans have different costs, which can include premiums, deductibles, and copays. Some plans have $0 premiums, but users still need to pay their Part B premium.

- Prescription Drugs: Most Medicare Advantage plans include coverage for prescription drugs (Part D).

Who Can Get Medicare Part C?

To get Medicare Part C, you must already have Medicare Parts A and B, live in the service area of a Medicare Advantage plan, and be a U.S. citizen or lawful resident.

How to Enroll in Medicare Part C

- Initial Enrollment: You can sign up during the three months before and after your 65th birthday.

- Annual Enrollment: From October 15 to December 7, you can switch plans or go back to Original Medicare.

- Special Enrollment: Life events like moving or losing coverage can qualify you for special enrollment.

- Medicare Advantage Open Enrollment: From January 1 to March 31, you can switch back to Original Medicare.

Understanding Medicare Part D (Prescription Drug Coverage)

Medicare Part D, also called "Prescription Drug Coverage," helps Medicare users pay for their prescription medications. This program ensures people have access to the drugs they need to stay healthy.

What Does Prescription Drug Coverage Include?

- Medicare Part D Focus: Covers the costs of prescribed medications for managing chronic conditions, illnesses, and preventive care.

- Plan Variety: Private insurance companies approved by Medicare offer different Part D plans to choose from, tailored to an individual's medication needs and budget.

- Plan Formularies: Each plan lists covered medications and costs, which can vary by tier.

- Cost-Sharing: Includes monthly premiums, deductibles, copayments, and coinsurance, with potential assistance for low-income individuals.

- Coverage Gap: Beneficiaries may pay more during the coverage gap phase but receive discounts on specific drugs.

Eligibility for Medicare Part D

To enroll in Part D:

- Qualify for Medicare due to age (65 or older) or specific health conditions.

- Must be enrolled in Medicare Part A or Part B.

Key Benefits and Services

- Coverage for a range of prescription drugs.

- Choose from various plans to fit needs and budget, with potential financial assistance available.

- Reduction in the coverage gap and eligibility for catastrophic coverage.

How to Enroll?

- Initial Enrollment Period (IEP): Seven months around your 65th birthday.

- Annual Enrollment Period (AEP): Every year from October 15 to December 7.

- Special Enrollment Period (SEP): Available due to specific life events.

To avoid extra fees, it's important to sign up for Medicare Part D during your Initial Enrollment Period. If you wait and don't have another good prescription drug plan, you might have to pay a penalty later. This penalty would increase your monthly payment when you do join. Picking the right plan that fits your needs and budget is very important to make sure you can get affordable prescription drugs.

Understanding the Four Parts of Medicare

When comparing Medicare's four parts (Part A, Part B, Part C, and Part D), it becomes clear how each part works differently to provide healthcare coverage.

- Part A and Part B: These are the original parts of Medicare, covering hospital and outpatient care. They allow you to choose your healthcare providers.

- Part C (Medicare Advantage): This part is an alternative to the original Medicare, often including prescription drug coverage and extra benefits, but you may need to use certain providers.

- Part D: This part focuses on prescription drug coverage and offers different plan options.

To get comprehensive coverage, you can combine Parts A and B with a separate Part D plan or choose a Medicare Advantage plan that includes drug coverage. The decision depends on individual healthcare needs and budget, as each part addresses different aspects of healthcare coverage, from hospital stays to doctor visits and medications.

Tips for Making the Most of Your Medicare Coverage

Making sure you get the best out of your Medicare coverage is really important for your health and for keeping costs down. It's so important to understand things like deductibles and copayments, so you can plan for any extra costs you might have to pay. One way to help with this is to think about getting extra insurance, like Medigap policies, which can cover some or all of the extra costs that Original Medicare doesn't pay for. These plans can give you peace of mind and help lessen the financial strain of healthcare costs.

As well as looking into Medigap, it's wise to save money by comparing different Medicare Advantage and stand-alone Medicare Part D plans to find the best options for your health needs. It's also a good idea to use preventive services, choose generic medications when you can, and see healthcare providers who are in your plan's network to save money. Making sure to review your coverage every year, thinking about any changes in your health, and getting advice from Medicare counselors or insurance experts can help you pick the right coverage for your health and wallet.

Empower Your Coverage Journey with Lehigh Partners Senior Benefits

Finding the right insurance coverage can be overwhelming, but with Lehigh Partners Senior Benefits, you're in good hands. Their team is dedicated to helping you navigate through your options and understand your coverage. Whether you prefer a phone call at (833) 265-9655, want to explore online, or schedule an personal appointment, Lehigh Partners Senior Benefits is committed to providing personalized assistance every step of the way.

FAQ about Medicare

No, you can't have both Medicare Part A and Part C together. When you join a Medicare Advantage plan (Part C), it usually includes all the benefits of Original Medicare (Part A and Part B) and may have extra benefits. You will automatically leave Original Medicare when you join a Medicare Advantage plan. But if you decide to switch back to Original Medicare, you can do that during certain times.

Even though Original Medicare covers important healthcare needs, many people choose to add extra coverage to lower their costs. Some options include getting a Medigap policy to help with deductibles and copayments, enrolling in a stand-alone Medicare Part D plan for prescription drugs, or choosing a Medicare Advantage plan for extra benefits.

Yes, you can change your Medicare plan during specific times of the year. The Annual Enrollment Period (AEP) is from October 15 to December 7, when you can make changes to your Medicare Advantage or Part D plans. There are also Special Enrollment Periods (SEPs) for certain life events, like moving or losing other coverage, which let you change your plan outside the AEP.

Usually, Medicare doesn't cover healthcare services outside the United States, but there are some exceptions. For example, Medicare Part A might pay for certain hospital care in foreign countries in specific situations. If you travel abroad, you might want to think about getting travel insurance or international health insurance. If you plan to live abroad, you might need to look into other healthcare options, like private international health insurance or the healthcare system in the country where you live.