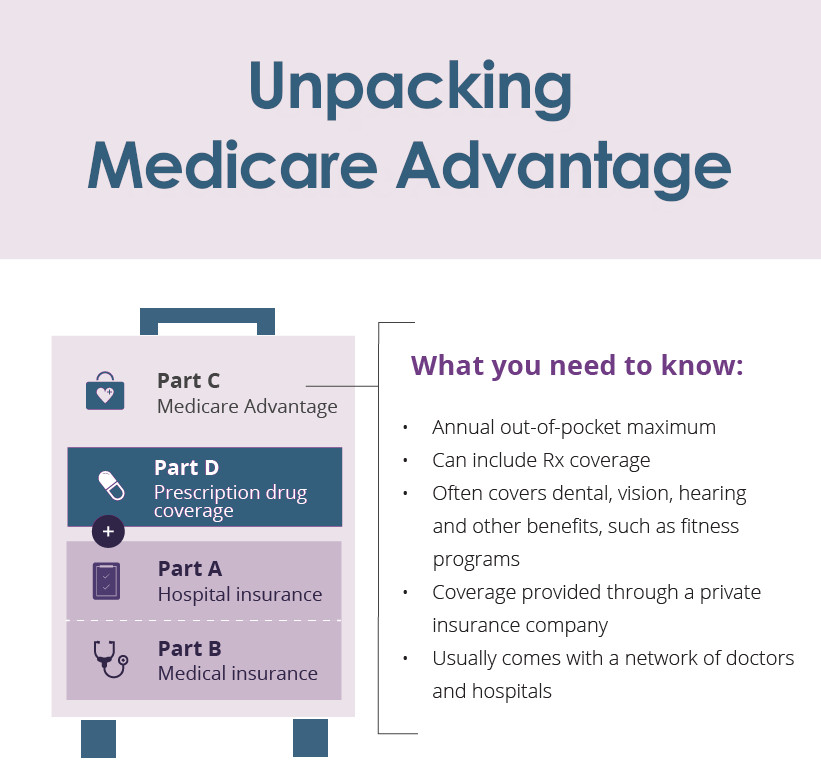

Medicare Advantage (part C) is a convenient way of managing healthcare costs as it allows you to get everything you need under one roof. These plans are provided by private insurance companies approved by Medicare and referred to as Medicare Part C. Essentially, every Medicare Advantage plan includes coverage for everything that Original Medicare (Parts A and B) covers. Additionally, Medicare Advantage plans may also provide coverage beyond what is offered by Original Medicare, such as dental, vision, hearing, and fitness club membership benefits. Some plans even include prescription drug coverage. In a nutshell, Medicare Advantage serves as an all-in-one plan that offers comprehensive coverage for your healthcare needs.

What does choosing Medicare Advantage mean for your health care costs?

Choosing Medicare Advantage can have implications for your healthcare costs, with some key differences compared to Original Medicare. Here are the main variations:

Premiums: After selecting a Medicare Advantage plan, you will continue to pay the monthly Part B premium to Medicare, and sometimes an additional premium to the plan provider. However, there are Medicare Advantage plans that do not charge an extra premium.

Deductibles: While Original Medicare has standard deductibles, Medicare Advantage plans may have different variations, with some plans not requiring any deductible payment at all.

Copayments: Plans may have lower copayments for doctor visits compared to Original Medicare, where you may have to pay a higher amount for care.

Firm limit on costs: In the event of unforeseen medical needs, Medicare Advantage plans come with a fixed limit on how much you have to pay for covered medical care each year. Once this limit is reached, no additional expenses for covered services are incurred. Original Medicare does not have this limit.

Here are the main points to consider when comparing Medicare Advantage plans, also known as Part C:

- Medicare Advantage plans have an annual out-of-pocket maximum.

- These plans often include prescription drug coverage.

- Additional benefits may be included, such as dental, vision, hearing services, and fitness programs.

- Coverage is provided by private insurance companies.

- Medicare Advantage plans usually come with a network of doctors and hospitals.

How do plans provide extra benefits at a reasonable price?

Medicare Advantage (part C) plans leverage care networks to provide additional benefits at a reasonable price. These networks consist of contracted doctors and healthcare professionals. It is important to stay within your plan's network to ensure coverage, but emergency care or urgent care outside the network may still be covered. It is recommended to check if your preferred doctors are part of the plan's network before enrolling.

What’s the difference between an HMO and PPO plan?

There are different types of Medicare Advantage plans, the most common being Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMO plans generally require staying within the network and obtaining referrals for specialist visits, with exceptions for emergencies or out-of-area urgent care. PPO plans, on the other hand, have higher monthly premiums but offer more flexibility in choosing doctors without referrals, including the option to see providers outside the network at an additional cost.

Traveling with Part C

For those who travel regularly, it is essential to ensure coverage while on the road. Medicare Advantage (part C) plans typically have a defined service area, limiting availability to specific regions and healthcare networks. However, some plans focus on multiple regions, allowing coverage for individuals who spend time in different locations. It's important to check if there are in-network doctors in both places.

Advantage plans can offer additional benefits such as lifestyle coaching programs, multidisciplinary care management teams, and online tools and resources for making healthy decisions and managing conditions.

How to Enroll into Medicare Advantage

Enrolling in a plan can seem like a daunting task, but working with an agent can simplify the process. The first step is to find an agent who specializes in Medicare plans and who is licensed in your state. When you meet with an agent, they will explain the different Medicare Advantage plans available to you and help you select one that meets your needs. They can also answer any questions you may have, such as how to transition from your current coverage.

Once you have chosen a plan, the agent will help you complete the enrollment process. They can also help you understand any costs associated with the plan and explain the benefits of the coverage. Using an agent as your guide can make the enrollment process simple and straightforward.

In summary, Medicare Advantage combines the benefits of other parts of Medicare into a single plan, providing cost, coverage, and convenience. However, it's important to shop around and find a plan that aligns with your specific goals, taking into account the options available in your area.

Take the next step and find plans in your area here: >>Medicare Plan Finder