Say goodbye to unpredictable out-of-pocket costs and get the peace of mind you deserve with a Medicare Supplement Insurance Plan.

Medicare Supplement insurance puts you in control.

Medicare Supplement insurance plans (also known as Medigap) work with Original Medicare to provide you with predictable out-of-pocket costs. This puts the financial control and planning for future medical expenses right where it belongs... with you.

How Medicare Supplement plans work with Medicare.

To understand how a Medicare Supplement plan works it is important to start with a basic understanding of Medicare, which has four parts.

Part | Description | |||

|---|---|---|---|---|

Part A and B | Original Medicare This is a federal health insurance program primarily for Americans age 65 and over. Original Medicare includes Part A (hospital coverage) and Part B (Medical Coverage). Typically, Medicare Part B only covers about 80% of your Medical Expenses | |||

Part C | Medicare Advantage These plans are an all-in-one alternative to Original Medicare Parts A and B and usually provide additional benefits like prescription drug coverage. Most Medicare Advantage Plans are network-based, don't always provide protection for unexpected costs, and cannot be combined with a Medicare Supplement. | |||

Part D | Prescription Drug Coverage These Plans help pay for your prescription drugs. Some Medicare Advantage plans include Part D coverage. If it's not included, they can be purchased separately. You can also purchase a Part D plan along with a Medicare Supplement to provide more complete coverage. | |||

Medigap | Medicare Supplement Purchased in addition to Original Medicare, Medicare Supplement plans provide peace of mind by covering many of the costs that Original Medicare doesn't pay. Unlike Medicare Advantage, Medicare Supplement Plans have no network restrictions, as long as the providers you choose accept Medicare patients. And Medicare Supplement plans help you control your out-of-pocket costs, which can add up quickly. | |||

A Medicare Supplement plan puts you in control.

A Medicare Supplement insurance plan helps cover the out-of-pocket costs not paid for by Original Medicare. These costs could add up to hundreds and even thousands of dollars a year.

Fill the gaps of Medicare with Medigap.

Here is an example of how a Medicare Supplement plan covers the costs not paid by Original Medicare.

What you pay: | with Original Medicare | with Medicare and a Medigap Plan G | ||

|---|---|---|---|---|

Part A hospital deductible (2024) | $1,632 | $0 | ||

Part B medical deductible | $240 | $240 | ||

Doctor visits | about 20% of the Medicare approved amount | $0 | ||

Days 61-90 in the hospital | $400 a day | $0 | ||

Days 21-100 in a skilled nursing facility | Up to $200 a day | $0 | ||

The biggest benefit is peace of mind.

With a Medicare Supplement plan, you'll avoid the hassles of finding a new doctor, shopping for a plan each year, or unexpected network changes.

No surprise out-of-pocket costs, and plans with low to no co-pays.

Like your Doctor? Keep them if they accept Medicare patients.

Plans go with you when you travel in the U.S.

No Networks. No referrals needed.

Get guaranteed coverage for life.

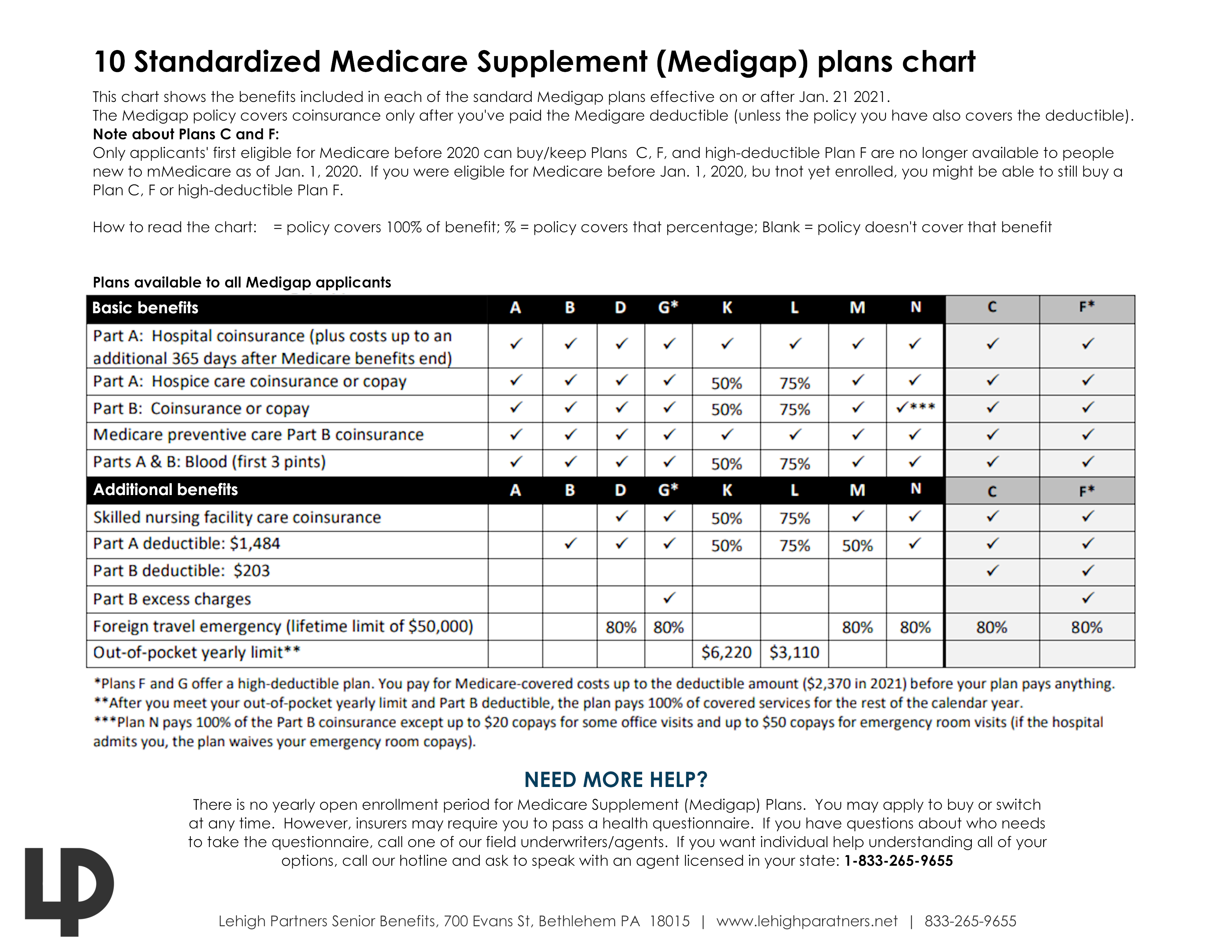

10 standardized Medicare Supplement plans chart.

Don't be surprised with out-of-pocket Medicare expenses.

You may have seen some of the advertising for Medicare Advantage plans and for some people, it may be a good choice. It's important to remember that although a Medicare Advantage plan may have a $0 premium, it doesn't mean that the plan is free.

With Medicare Advantage, you still have to pay for many of the out-of-pocket costs not paid by Medicare, including co-pays, coinsurance and deductibles. This amount, depending upon the plan chosen, can be as high as $8,300 in 2023 for in-network and may be even higher for out-of-network services. Also you may be required to use network doctors and hospitals, and may need referrals to see specialists.

A Medicare Supplement plan puts you in control. No need to worry about finding a new doctor, shopping for a plan each year, facing annual benefit or network changes or getting referrals. You can see any provider you want who accepts Medicare patients and you are guaranteed coverage for life, as long as you pay your premiums when due.

Depending on the plan you choose, you choose, you may receive coverage for many out-of-pocket expenses that Medicare Parts A and B don't cover, such as:

- Deductibles

- Coinsurance

- copayments (co-pays)

Call Lehigh Partners Senior Benefits to request your rate quote.

Speak to a licensed insurance agent today.

1-833-265-9655 (TTY 711)

Ready to Apply?

When: Once enrolled in Medicare Part A and Part B, you can apply for a Medicare Supplement insurance plan at any time. The best time is during your six-month Medicare Supplement Open Enrollment Period (OEP). This starts the first day of the month in which you are both age 65 or older and enrolled in Part B.

Why: In addition to helping pay some of the out-of-pocket expenses that Medicare doesn't pay, Medicare Supplement plans offer guaranteed coverage, meaning your plan will continue year after year, regardless of age or health.

Ready to take charge of your health care?

Now that you understand the unique benefits of a Medicare Supplement insurance plan, peace of mind is just a phone call away.

Call Lehigh Partners Senior Benefits to speak with a licensed insurance agent.

1-833-265-9655 (TTY 711)

Don't Delay

If you delay your enrollment in a Medicare Supplement plan outside of Open Enrollment or Guaranteed Issued periods, you may be underwritten and may not be accepted into the plan, or if you are accepted, your rate may be higher.