What is Medicare?

Medicare is a federal health insurance program that provides coverage to millions of Americans aged 65 and older, as well as individuals with certain disabilities. Understanding Medicare eligibility is crucial to ensure you can access the healthcare benefits you need. In this guide, we will explore the age and qualification requirements for Medicare, answer common questions, and provide guidance on determining your eligibility.

Who is eligible for Medicare?

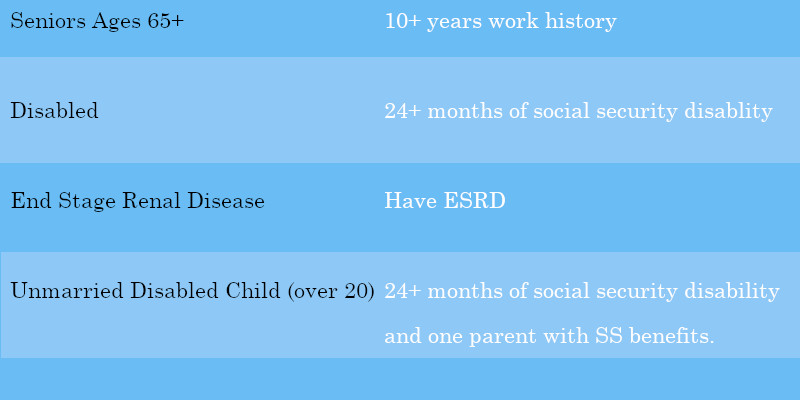

The primary criterion for Medicare eligibility is age. Most people become eligible for Medicare at age 65 or older. However, there are exceptions for individuals with certain disabilities or end-stage renal disease (ESRD). If you have received Social Security or Railroad Retirement Board disability benefits for 24 months, or if you have ESRD, you may qualify for Medicare before turning 65.

Get started with Lehigh Partners today

Medicare Advantage plans offer benefits beyond what Original Medicare covers. Explore plans in your area today!

Automatic enrollment at 65?

Many individuals wonder if they are automatically enrolled in Medicare when they turn 65. While some people are automatically enrolled, others need to take action to initiate their Medicare coverage. If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B. However, if you are not receiving these benefits, it is essential to understand when and how to enroll.

Medicare eligibility age chart

Here’s a quick look at the first year of Medicare eligibility based on birth year.

Birth Year | Medicare Eligible |

|---|---|

1959 | 2024 |

1960 | 2025 |

1961 | 2026 |

1962 | 2027 |

1963 | 2028 |

1964 | 2029 |

Medicare for non-workers

One of the common misconceptions about Medicare is that you must have a work history to be eligible. However, even if you have not worked, you may still qualify for Medicare. If you are married to someone who has the required work history, you may be eligible under their work record. Additionally, individuals who have never worked may also qualify for Medicare based on their spouse's work record.

Medicare for working individuals

If you are still working when you turn 65, you may be wondering if you can still get Medicare. The answer is yes. You can enroll in Medicare even if you are working and have employer-sponsored health insurance. However, it is crucial to understand different enrollment periods, such as the Special Enrollment Period (SEP), which allows you to sign up for Medicare without penalties.

Cost of Medicare

Understanding the cost of Medicare is vital to plan your healthcare budget. Medicare Part A, which covers hospital stays, is usually premium-free for individuals who have worked and paid Medicare taxes for at least 10 years. Medicare Part B, which covers doctor's visits and outpatient services, typically requires a monthly premium. Additionally, there may be other out-of-pocket costs, such as deductibles and copayments, depending on the specific services you receive.

Enrollment timing

Enrolling in Medicare at the right time is crucial to avoid penalties and gaps in coverage. The Initial Enrollment Period (IEP) is the seven-month period surrounding your 65th birthday, during which you can enroll in Medicare. Missing this enrollment window could result in late enrollment penalties. However, there are exceptions, such as having employer coverage, which may allow for a Special Enrollment Period (SEP) at a later date.

When does my Medicare coverage start?

The month your coverage starts depends on when you sign up.

If you sign up | Your Medicare coverage starts |

|---|---|

1–3 months before your 65th birthday | Your birthday month |

During your birthday month | The next month |

1–3 months after your birthday month | The next month |

Eligibility for Medicare Parts C, D & Medigap

In addition to Original Medicare (Parts A and B), there are other Medicare options available. Medicare Part C, also known as Medicare Advantage, is offered by private insurance companies and provides additional benefits beyond Parts A and B. Medicare Part D offers prescription drug coverage, and Medigap policies can help cover gaps in Original Medicare. Eligibility requirements for these options vary, so it's essential to explore your options to ensure you qualify.

How to check eligibility

Determining your Medicare eligibility is relatively straightforward. To check your eligibility online, you can visit the official Medicare website and use their eligibility tool. Additionally, you can contact the Social Security Administration or your local State Health Insurance Assistance Program (SHIP) for personalized assistance and guidance on eligibility.

Do I qualify for Medicare?

To see if you qualify for Medicare, try 1 of these methods:

- Visit Medicare.gov to verify your eligibility.

- Call 800-MEDICARE (800-633-4227) (TTY: 877-486-2048), 24 hours a day, 7 days a week.

Before you call, be sure to have the following information ready:

- Your date of birth

- Number of years you worked and paid Medicare taxes

- U.S. state or territory of residence

- Current health benefits through an employer (if you have them)

- Disability status

Conclusion

Understanding Medicare eligibility is essential to ensure you receive the healthcare benefits you need, especially as you approach the age of 65 or have specific disabilities. In this guide, we have covered the age requirements, qualifications, and various aspects of Medicare eligibility. We encourage you to take the necessary steps to determine your eligibility by using the available resources or seeking assistance from the Social Security Administration or SHIP in your state. By being informed and proactive, you can make the most of your Medicare coverage and access the healthcare services you deserve.

Contact us today at 833-265-9655 for more information and personalized guidance on Medicare eligibility and enrollment. Our expert team is ready to assist you in making informed decisions about your healthcare coverage options. Don't miss out on the benefits you're entitled to – act now and secure your Medicare coverage for a healthier future!