When you enroll in Medicare, you may be wondering if you need additional coverage alongside your Original Medicare plan. Medicare Supplement Plans, also known as Medigap, can be an excellent option for those seeking extra financial protection from healthcare costs.

Medicare Supplement plans provide coverage for healthcare expenses that are not fully covered by Original Medicare.

What is a Medicare Supplement?

A Medicare Supplemental insurance plan, often referred to as a Medigap policy, works alongside your Original Medicare coverage to help pay for expenses that are not fully covered by Medicare. These plans are sold by private insurance companies and offer standardized coverage options that help cover coinsurance, copayments, and deductibles.

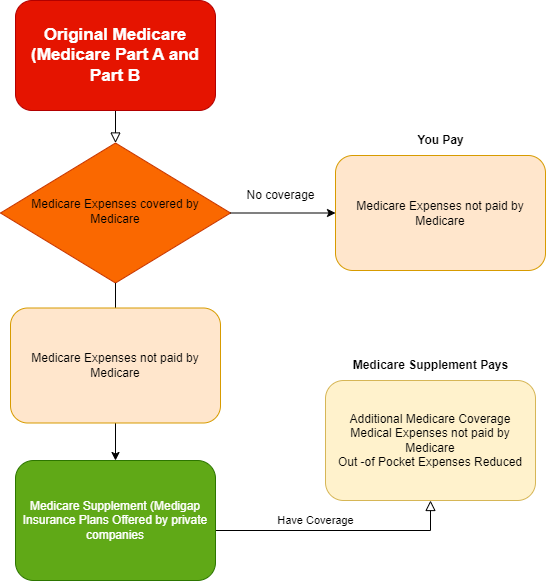

Here is a diagram that outlines how Medicare Supplement works:

In this diagram, Original Medicare (consisting of Medicare Part A and Part B) provides the primary coverage for medical expenses. However, there may be gaps in coverage, such as deductibles, copayments, and coinsurance, that the Medicare beneficiary (individual) is responsible for paying out-of-pocket.

To bridge these gaps, the individual has the option to purchase a Medicare Supplement plan (Medigap) offered by private insurance companies. These plans are designed to complement Original Medicare by covering some or all of the out-of-pocket expenses. Medicare Supplement plans are standardized and labeled Plan A through Plan N, each offering different coverage options.

By enrolling in a Medicare Supplement plan, the individual can reduce their out-of-pocket expenses and have more predictable healthcare costs. This additional coverage is provided by the Medigap policy, which helps fill in the gaps left by Original Medicare.

It's important to note that Medicare Supplement plans cannot be used in conjunction with Medicare Advantage plans (Part C). However, they can be used alongside Original Medicare to provide additional financial protection and peace of mind for Medicare beneficiaries.

What are the Top Medicare Supplement Plans?

There are ten standardized Medicare Supplement plans available in most states, labeled Plan A through Plan N. Some of the most popular plans include Plan F, Plan G, and Plan N, which offer the most comprehensive coverage options.

Medicare Supplement insurance Plans can be an excellent option for those seeking financial protection from healthcare expenses. However, it’s crucial to consider your individual healthcare needs when choosing a plan.

Do I Need a Medicare Supplement Plan?

Whether or not you need a Medicare Supplement plan depends on your individual healthcare needs. If you’re comfortable with paying out-of-pocket expenses, you may not need a supplemental plan. However, if you have frequent medical visits, or you anticipate needing more extensive healthcare services, a Medicare supplement plan may provide substantial financial protection.

In summary, Medicare Supplement plans can be an excellent option for those seeking financial protection from healthcare expenses. While it’s not mandatory to enroll in a supplemental plan, it can offer extensive coverage options for those with higher medical expenses. If you’re considering a Medicare Supplement plan, explore the top Medicare supplement plans available in your state and consult with one of our licensed insurance agent to ensure you’re making the most informed decision for your healthcare needs.